How Documenting Capture Intelligence Will Improve Your Win Rate

Five weeks ago, I

had the pleasure of presenting a webinar dissecting six key tactics to help

improve your win rate. These tactics include:

- Applying a thorough strategy in the opportunities pursued

- Starting pursuits earlier to gain an understanding of the customer and competitive landscape

- Documenting the intelligence gained from the business development and capture stages

- Applying rigor in the bid decision process

- Making your proposals easy to score

- Conducting lessons learned so you can understand where you are doing well and where you need to improve

In this week’s

article, I do a deep dive into another one of those critical tactics: documenting the

intelligence gained during the business development and capture phases.

Capture Planning

One of the biggest downfalls I see with the capture process

(other than skipping the capture phase completely) is a lack of capture

documentation. Once the company decides to pursue a potential opportunity, the capture manager needs to be diligent in documenting the information learned and

gained. Customer Relationship Management, or CRM tools, such as Deltek or

SalesForce, are useful tools for this. But if your company isn’t to the point

where they are using a CRM, your proposal infrastructure tool, whether it’s

SharePoint or another tool—is a great way to document and share this

information as well.

The key here is that the information needs to be documented

and distilled so that it’s useful for the proposal team when the RFP hits. An

effective capture manager builds the approach and win themes around

intelligence gathered and documented during the capture phase. But how often

have you entered the proposal phase with an incomplete or nonexistent Capture

Plan? The Capture Plan is a critical document for transferring knowledge of the

customer, opportunity, and competition to the proposal team. I’ll use the

analogy of baking a cake. If the ingredients you put into the batter are

rotten, or you leave out a critical ingredient, what kind of cake will result?

If the capture information feeding your proposal is similarly bad or

incomplete, you can expect a comparable proposal product.

Executing the Call

Plan

During the capture

phase, the capture team should meet with the customer to dig into the key

issues that surround their program and to better understand the drivers behind

the solicitation. Through these discussions, the capture manager, potential

program manager, and other potential key personnel should aim to have

discussions that dig into what the customer wants and needs, what keeps them up

at night, if they have any preferences or issues surrounding the upcoming

solicitation, the problems they might be facing, and what their true goals

really are. As part of these discussions, the team should aim to try to figure

out who the key decision makers are, if they are aligned, or if there are

conflicting opinions among the customer organization. If possible, the team should try

to find out whether there are any constraints, standards, or other restrictions

that might affect their decision. Other key questions the team should try to

answer include whether there is funding allocated for the opportunity, whether

the customer likes the team’s potential solution, and whether there are ways

the company can shape the opportunity to make it difficult for other bidders to

win.

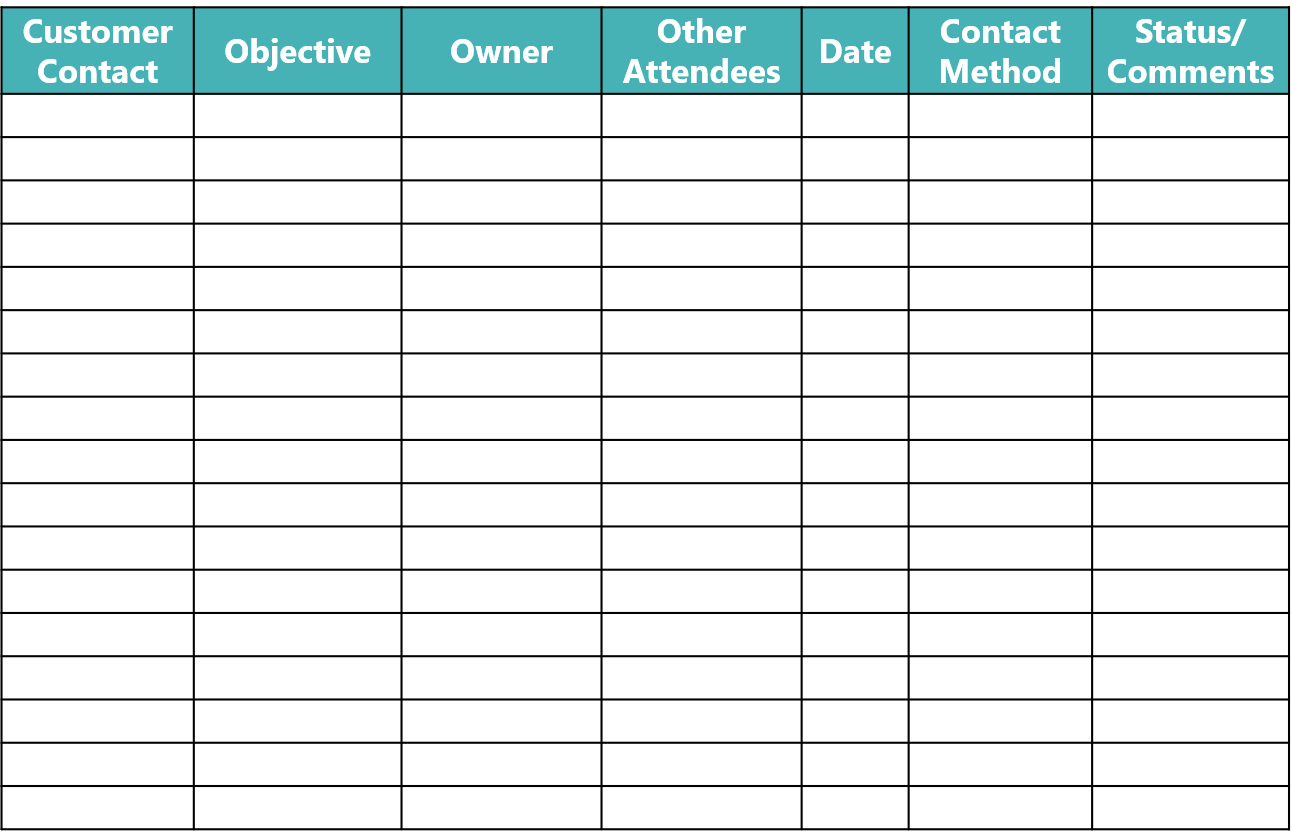

One way the team

should approach answering these questions is through the Call Plan. The Call Plan

documents the plan for communicating with the customer, who will meet with each

customer point of contact, and what the desired outcomes are for each meeting.

In executing the call plan, business development or capture personnel may talk

directly to managers from the procuring organization, company program managers

may talk to their customer program managers, company executives may talk with

contacts at a high level within the customer organization, and/or candidate

company key personnel may talk to their customer counterparts. Reaching the

customer at these different levels brings an understanding of the customer from

multiple levels and tiers and helps to identify any differences in opinions,

any conflicting agendas or goals, and areas where the company is favored or

less favored. Learning this early on gives the company time to further build

relationships with champions and potentially start to sway any decision makers

who may be on the fence. Below I provide an example of a call plan format.

Sample Questions

Some sample

questions that you might use to spark discussions with the clients when

executing the call plan include:

- Have you tried. . .?

- Have you ever thought of. . .?

- Would you be interested in. . .?

- Would it work better if. . .?

- What do you think about. . .?

- How will you want to go forward with the project?

- What are some of the challenges you foresee with this contract?

- What are some of the things a potential contractor could do to make your life easier?

- What are the various needs at each agency level (field office, regional, headquarters)?

- What do you have to do to get the ball rolling?

- What kind of contract are you looking to use—fixed-price, award fee, performance-based?

- We provided XYZ solution for a similar project. Do you think that would work for this contract?

Note that most of

these are open ended to get the customer talking about their challenges and

issues, or to vet ideas that the team might be thinking about proposing. These

discussions should focus on understanding the customer and the type of

solutions that would best meet their needs. Too often, teams go into these

customer meetings focusing on their own company and presenting their

capabilities. That may have its place later in the process; however, like your

proposal should be about the customer and the benefits they receive from your

solutions—these meetings should be about the customer and exploring the

benefits they would like to gain from a potential solution—and understanding

better what that solution might look like.

Developing the

Capture Plan

Once the company has

identified and qualified the opportunity, the company should develop a Capture

Plan to plan and document the win strategy. At this point, the call plan

becomes part of the capture plan. A good capture plan is specific, detailing

the objective, actions to be taken, who is responsible for the actions, the

timing of the actions, and the frequency of the review. The Capture Plan

documents key solution elements, including the opportunity description,

customer analysis, competitive analysis, teaming options, call plan, solution

analysis and development, win strategy development, and proposal strategy

development. When done correctly, up the 80% of the data documented in the

capture plan will eventually transfer to the proposal, so a more comprehensive

capture plan will result in a more effective and efficient proposal process.

Customer Analysis and

Notional Winner Profile

A key outcome of

customer analysis conducted during the capture phase is the Notional Winner

Profile (NWP). The NWP is used to compile the optimum credentials,

capabilities, experience, and attributes of the likely winner or winning team.

It represents the characteristics of a hypothetical ideal company or team of

companies to do the work. The NWP becomes the benchmark against which decisions

on strategy, teaming, and the competition are made. To complete the NWP, the team should first

identify the key attributes required to meet the customer requirements. Sources

that help in generating this list include all published procurement documents,

marketing information, strategic consultant input, and the bidding team’s

internal knowledge. Basic elements include:

- Corporate Profile: size, revenues, financial strength, number of personnel, depth of resources, and financial capabilities, image in the marketplace, evidence of corporate commitment

- Cost: low cost, best value, best design for available funding

- Staffing: capture incumbent workforce; bring new blood, skills, and qualifications

- Technical Qualifications: core competencies, required systems

- Bidding Entity: optimal business model or teaming construct

- Past Performance/Experience: agency specific, technology oriented, cost/schedule performance

- Company Size: big or small company bias

- Key Personnel: qualifications, education, experience

- Risk: risk and liability posture.

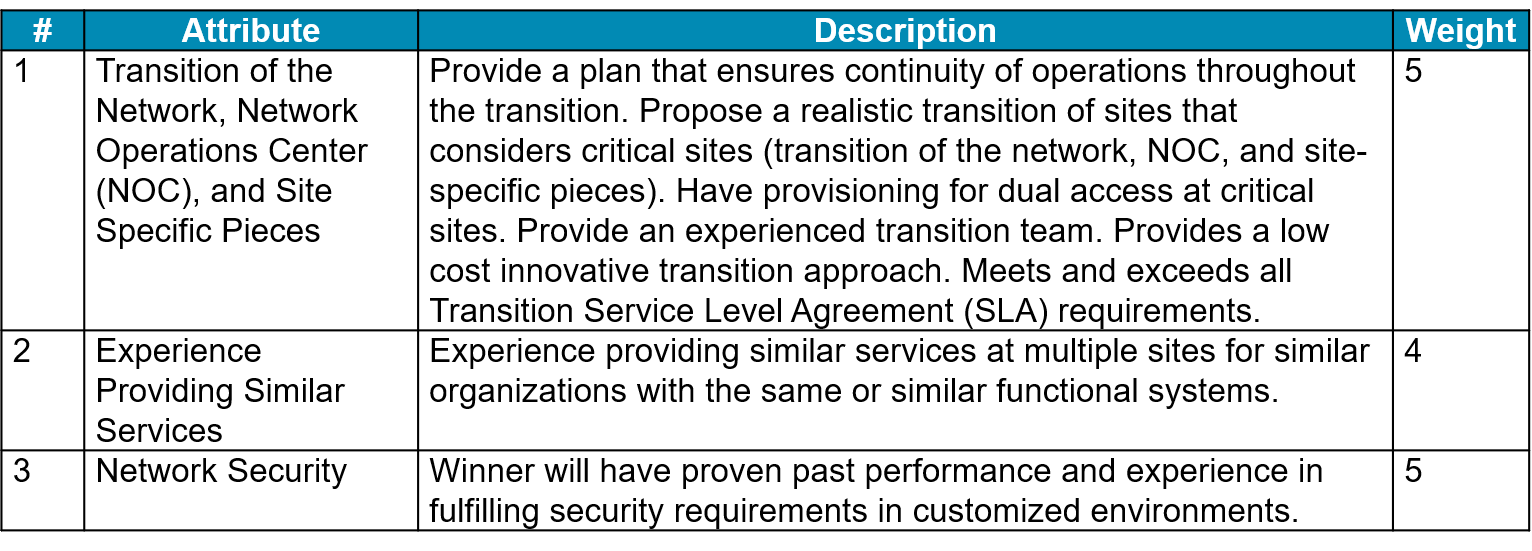

For each identified

attribute, develop a brief description of anticipated evaluator preferences,

including nice-to-have items, as well as those items that could cause an bidder to lose points. Then assign a weight to each factor, using a scale of 1

– 5, with 5 being of highest importance. The team should be sure to identify

pass/fail items that constitute a fatal flaw if not appropriately addressed.

Assigning these weights helps the team focus on the more important evaluation

factors rather than wasting time on relatively unimportant items. These weights

will be used later to determine the competition and team scoring. A sample

NWP chart is shown below. The NWP should be validated and

updated as necessary at each major step of the procurement process: initial

development, draft RFP release, final RFP release and, if applicable, final

proposal revision. The NWP should remain a current and accurate reflection of

the procurement environment and enable the proposal team to stay focused on the

factors that can influence the evaluation.

Self-Assessment

Before assessing the

competition, you will need to honestly assess your company’s strengths and

weaknesses arrayed against the NWP using the Company

Scorecard. This internal assessment is important to highlight the competitive

strengths of the team to provide the proposal manager with an early opportunity

to focus these points and pinpoint the competitive weaknesses of the team to

allow focused measures to correct deficiencies. Your company can mitigate

weaknesses identified early through teaming, strategic hires, approach

development, marketing, and other strategies. Identify those strengths to

capitalize on them, but also recognize that merely stating them is not enough.

It is necessary to incorporate the team strengths into the approach and

articulate the resulting benefits to the customer. Remember, company strengths

must matter to the customer.

A sample Company

Scorecard is shown on the screen. Each scorecard contains the following

elements:

- Attributes and Description: from NWP

- Weight: also from NWP

- Attribute Raw Score: how well the company is rated for a given attribute (0 = Poor, 10 = Superior)

- Weighted Score: the mathematical product of the weight of the attribute times the raw score of the company expressed as a number

- Comments/Rationale: support the score for each team with a brief description (1 – 2 sentences).

Competitive Analysis

After conducting the

self-assessment, the capture team should evaluate the known competition (either

the individual primes or the teams, if known) against the same NWP criteria.

Early identification of competitor strengths and weaknesses enables the team to

develop and implement appropriate countermeasures. As part of this process, the

team should compile the likely win strategies of all known competitors. Drawing

on the NWP, the Competitive Assessment incorporates the following items:

- Description of the competition teams’ configurations

- Definition of the win attributes (NWP)

- Competitor scoring against the attributes

- Summary scores and analysis

- Key discriminators and anticipated elements of the offer.

Sources of

information for the Competitive Assessment include: internal competitor files,

teammates, marketing personnel, contracts, contract modifications, source

selection documents, financial reports, the customer’s buying habits, and

general internet searches. The results of the Competitive Assessment will:

- Highlight competitor strengths in time to develop and implement mitigation strategies

- Assist in the development of “ghosts” for the proposal that facilitate highlighting and examining weaknesses of the competition

- Attempt to duplicate the analysis used by the Source Evaluation Board (SEB) of what constitutes the differences among all the proposals.

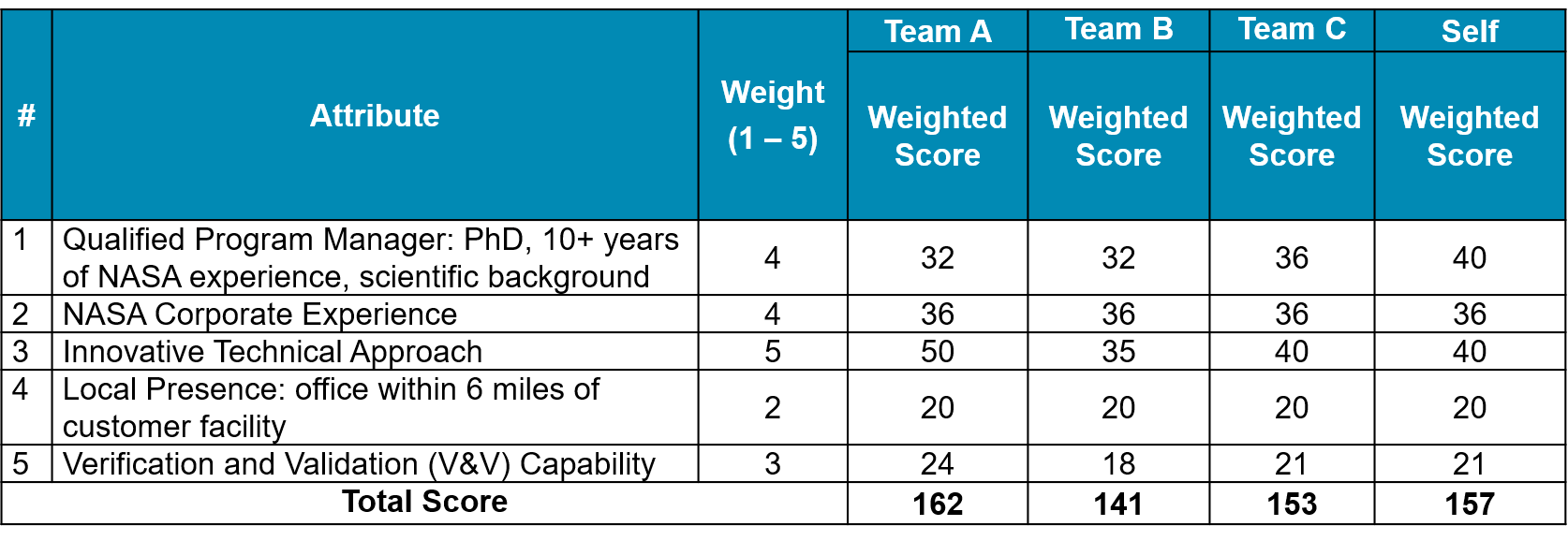

After scorecards are completed for your company and each

competitor, the Capture Manager should summarize the information on the Summary

Scorecard. The summary scorecard permits a

side-by-side analysis of the company’s relative strengths and weaknesses

against the competition. After identifying areas with the greatest variance

(either positive or negative), it is possible to begin to develop strategies

for shoring up the team by adding partners or weakening the competitors’ teams

through strategic teaming to capture critical subcontractors. A sample

Summary Scorecard is shown below.

Teaming Strategy, Win

Strategy, Value Proposition, Hot Buttons, and Themes

As you’re moving

through the capture phase, it’s critical that you continue to capture the

information that you’re learning from industry partners, the customer, and

other sources. As you understand your capability gaps and any small business

requirements on the procurement, you’ll want to develop and document your

teaming strategy. This includes shoring up the team with non-disclosure

agreements and teaming agreements. You’ll also want to analyze your solution,

determining whether it will resonate with the customer and outperform the

competitors. During this time, you’ll also want to make a final pursuit

decision. Once you decide for sure that this opportunity is something that the

team should go after, you’ll want to develop your win strategy (i.e., how are

you going to outshine the competition), put together your proposal team, and

start establishing your proposal infrastructure.

The win strategy is

a critical element that will help you understand how to articulate what sets

you apart from your competitors and help improve your chances of winning. Aligned

with the win strategy is the value proposition. The value proposition

summarizes the case for why your company should be awarded the contract—it is

the customer’s rationale or justification for awarding you the win. When

developing your value proposition, you should start with the information the

customer needs to justify selecting your company, and then give the evaluators

the key points they can highlight as supporting evidence, quantifying where

possible. Defining this value proposition is extremely difficult when you don’t

understand the customer and their needs—that’s why it’s so critical to start

early and gain the necessary customer intelligence.

Yet another critical step in the capture phase is documenting

the hot buttons and section themes. This helps the writing team to understand what

the customer cares about. When the writing team doesn’t have a list of customer

hot buttons and section themes before the RFP is released, the first drafts must

default to generic approaches that won’t resonate with the customer. Going back

to retrofit narrative to address customer hot buttons and weave in win themes

takes so much more time than writing to them in the first place. In addition,

this delayed approach often results in awkward flow and stilted content. Identifying

hot buttons and win themes early enables the team to develop approaches that

directly address the customer’s concerns and highlight the strengths of the

team. This supports stronger content from the beginning, saving time and

resulting in higher quality final proposal content. This will also make the

proposal content more compelling and customer-focused, resulting in

higher-scoring proposals and improving the win probability.

Final Thoughts

In this world of

bids and proposals, we all certainly want to win more. However, there are so

many factors that impact a company’s probability of win, and a number of things

throughout the opportunity lifecycle can impact a company’s chances of winning

(both positively and negatively). However, one that you can do to

positively impact your chances of winning is to document your capture intelligence

in the Capture Plan. The Capture Plan is a critical document for transferring

knowledge of the customer, opportunity, and competition to the proposal team.

Without these details, the proposal team is forced to develop a generic

response that is very unlikely to resonate with the customer. A well-developed

Capture Plan will identify customer hot buttons and win themes, supporting

stronger proposal content from the beginning. This saves time and results in

higher quality, compelling, and customer-focused proposal content, which leads

to higher-scoring proposals—and significantly improves the probability of win.

Written by Ashley (Kayes) Floro, CPP APMP

Senior Consultant and President

Proptimal Solutions, LLC

proptimalsolutions.com

LinkedIn

I think this is one of the most important pieces of information for me. And I’m glad to read your article. Thank you for sharing. strategic management consultant

ReplyDeleteExcellent article and with lots of information. I really learned a lot here. Do share more like this.

ReplyDeleteSalesforce Training Institute in Chennai

Salesforce Certification Training

Salesforce Training in Bangalore